Mine the gap - February 2024

Dear Partners,

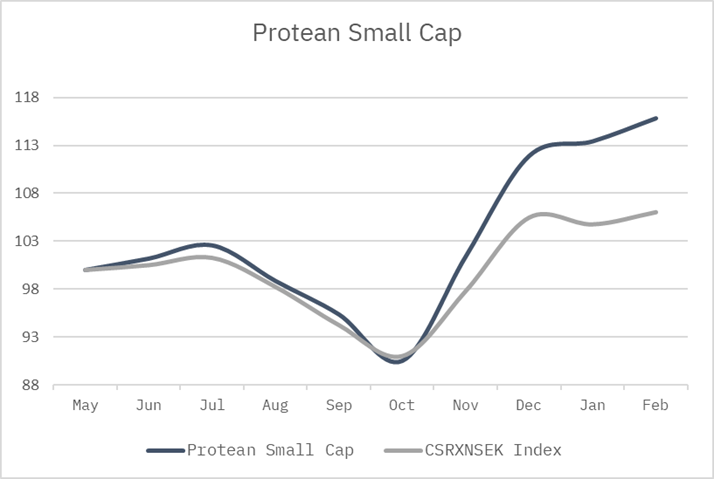

Protean Small Cap continued its strong performance and returned +2.1% in February. That was 0.9% ahead of the CSXRN (SEK) benchmark index. Performance since inception in June 2023 stands at +15.9%, outperforming the index by 9.8% in nine months.

Top contributors were Cargotec, ITAB Shop Concept, Ambea, Maven Wireless and Cint.

Notable detractors were Kambi and SOBI.

Protean Select posted 0.25% return for the month. That’s +1.24% YTD and +14.94% since inception 22 months ago. The realized volatility in the strategy keeps hovering around 7%, which can be interpreted as a return generated with about a third of the risk of the overall market.

Top contributors were Cargotec, Ambea, Nordnet and Swedbank.

Notable detractors include short index futures, longs in SOBI and Rusta.

This month’s letter elaborates on recent performance, our thoughts on why we’re watching the struggling Boliden closely, and our most recent joiner Ramil shares his learnings from making the move to investing from selling research.

Thank you for being an investor!

//Team Protean

What happened in February

The normalisation continues as markets drifted higher. The last bear has not capitulated as we are still hearing calls of “complacency!” amid options put/call skews that are among the lowest in recent history. In fairness though – complacency could simply be another word for adaptation: we get used to surprises, we work around them = things normalise. During February, global markets adjusted rather effortlessly to a sizeable change in rate cut expectations. Stocks shrugged this off, to many bears’ annoyance. Global PMIs broke above 50 for the first time in almost two years, consumer confidence is improving from low levels and labour markets reman resilient.

Here's a thought: if a part of economic recovery comes from productivity improvement, does it need to be inflationary?

A notable dog that did not bark is how normalisations of supply chains and therefore shorter lead times on orders did NOT capsize stocks that reported shrinking orderbooks during the Q4 reporting frenzy in February.

Cyclicals are outperforming defensives by a wide margin, but we note dispersion – with materials as a serious underperformer (more on Boliden later in the letter). The paper and packaging companies have been lagging too, despite early signs of improvements in fundamentals, and recent legislation (almost) passed by the EU that should help drive demand for fibre-based packaging solutions. They are due to catch up.

Banks are generally in very reasonable shape, with strong capitalization and ROE-metrics that keep climbing, considering efficiency gains and focus on fee income rather than NII-margins. It cannot be underestimated how important healthy banks are for capping the (big) downside in markets. It’s a bit like the best equity short cases are always those with leverage, in that the big market corrections come when banks stop working properly. With that in mind, a normalisation of markets is (was?) simply fair.

We, across both funds, continue to find interesting ideas among companies that have a somewhat dented narrative: crashed stocks that were listed during the QE hay days with lofty valuations, and that have failed to meet elevated expectations. A number of these have seen both changes to managements and adjustments of strategies. Most importantly, a handful of them are simply too cheap as investors have burned their fingers and fail to appreciate early signs of improvements. Occasionally this leads to an opportunistic bid – as in the Byggfakta and Pagero cases.

On the flip side stands the stark outperformance of large caps. Buoyed by relentless passive inflows there seems no stopping this organ grinding monkey from driving markets higher. When valuation-driven flows back to Europe starts to come in earnest – perhaps triggered by an inevitable tech fatigue in the US and a widening valuation gap – things could get interesting.

Boliden – Asleep at the wheel?

This Swedish 7bn USD mcap mining company is an orphan. Of the four top shareholders, three are passive global index funds. At the beginning of 2023, of the 20 biggest active Swedish funds, only one lonely fund held zero shares in Boliden. Fast forward to today, and 10 more have sold out completely, contributing to the 45% share price decline since the most recent peak in January 2023. Everyone has given up but passive anonymous money.

This is a problem because a weak shareholder base risks failing to hold the executive management accountable. It risks being run by bureaucrats, not entrepreneurs. It also opens for an opportunistic take-out at a discount, as there are no blocking minorities to safeguard a fair price. I can already imagine the headlines if a bid surfaces: “Assets of national interests threatened!”, “Critical strategic minerals being sold to foreigners!”. We have seen this movie before, and we don’t like the ending.

Not a software business

Boliden operates in a capital-intensive and cyclical industry with zero pricing power (they are price takers on a global market). It sounds 100% like a terrible business. It’s the mirror opposite of the popular asset light 99% gross-margin software companies trading on 10x sales.

But there is a crucial difference: the barriers to entry are massive and the long-term demand outlook is benign. Two guys can’t open a mine with a laptop in a garage in Palo Alto, regardless of how hard they try. It requires industrial skill and operational acumen to run a mine profitably over any duration of time. Plus, you do need the rights to the actual ore (preferably in a country with a credible legal and political system, stable electricity supply, and enough water for operations) – there aren’t many of these set-ups around!

From growth story to horror story

Speaking of operational acumen – Boliden has in the past years had an unusual number of hiccups. The large fire at Rönnskär, a faulty dam had to be re-engineered at a very steep cost (and they warn of another one being up for re-engineering too), flooding and cost inflation at the – now mothballed – Tara mine, the Kevitsa mine plan re-design due to instability, the Laver greenfield permit application recall, an important crusher break-down, and mine grades generally falling at a faster pace than anyone anticipated (or was guided for). Taken together, all this has led to an absolute explosion in capex. Free cash flow was negative in 2023 and will be so also in 2024.

Key to an equity case for a mining company is to a) do not let opex and maintenance capex grow faster than the underlying metal prices b) strike a balance between expansion capex and shareholder returns c) have a growth plan – as mines are depleting assets over time d) make sure your mines have good up-time and few operational snafus.

Right now, in the eyes of the market, Boliden ticks zero of these boxes. The growth is too far away, and nobody seems willing to believe in them (likely because of the repeated operational failures and lack of belief in management). The massive wave of capex puts a dent in shareholder remuneration. We are extrapolating more operational issues will pop up regularly going forward. In short: the market does not believe in management.

Management discount

Mikael Staffas has been CEO at Boliden since June 2018. Before him, Mr Evrell served 11 years as CEO. At a 2017 CMD, then-CEO Mr Evrell presented a (well-earned) bragging slide, showing Boliden’s share price vs global competitors and mining indices. It was a stellar outperformance.

Source: Boliden 2017 CMD slides

In the six years since Mr Staffas took over. Replicating the same image, with total shareholder returns (dividends re-invested) in USD, let’s just conclude we don’t think we’ll see a repeat of the slide at any CMD in the near term.

Comparing vs peers in USD is a potent method since all are price takers for the same USD-priced commodities on a global market. This is not a great scorecard.

Neither is the change in quarterly report receptions. In the six years preceding Mr Staffas appointment, the median reaction to a report was +2% on the day. The median since is -2%. The number of positive reactions on reporting day has gone from 57% prior, to only 35% since. To me, this is a testament to poor communication skills (in addition to poor execution).

We have spoken to multiple stakeholders in the Boliden network. Very few had positive things to say about senior management. The most common word used was “arrogant”, but “incredibly numbers focused” was also a recurring theme. “Old CEO Evrell cared about the people in the mines, very little of that left now” was also mentioned. Searching through press databases, the CEO has been lambasting analysts several times throughout history for “having too high expectations” and getting the numbers wrong – implying it’s been analysts’ fault the stock is a poor performer. The story from the other side is a frustration over poor disclosure, wide guidance ranges, and a general attitude toward questions that does not foster a constructive dialogue with the equity market.

We are cautious to conclude here, as there are always multiple sides to a story, and as outside observers, we rarely know the full story (and have a limited data set). However, it seems clear there is an issue with culture and communication. These two items land squarely at the CEO’s feet – and therefore it is an item for the Board of Directors to address. Preferably urgently. Hint: maybe 6 years and -8% TSR is a long enough time to evaluate Mr Staffas' performance?

There is a potent case in here somewhere

Despite – or maybe because of – the recent issues, Boliden could be a great equity case from here.

The market for metals, assuming the world is at least half serious about decarbonizing, is destined to see the demand side continue to grow substantially faster than the supply side.

Mining has historically been a boom-and-bust industry, but increased ESG-focus impacting permitting and limiting water usage, political unrest causing closures and expansion delays and resource nationalism reducing exports, has led to constraints on global mining capex despite relatively strong metal prices. As an example BHP, the world’s largest miner, last year invested less than half of what it did 10 years ago. What is today interpreted negatively by the market, namely that Boliden is investing heavily, could be turned into a positive when sentiment changes.

If we disregard the last year or two, Boliden has a long history of almost surprisingly strong value creation through efficient capital allocation. Maybe it is not different this time, as implied by the share price?

Source: Danske Bank

Surprise: electrification needs metals

We think there is a chance equity investors will wake up to what’s about to happen in metal markets. A notable recent entries to the field is $60bn+ activist investor Elliott (of SWMA fame) launching a new mining investment vehicle “Hyperion”. A move that, in the words of the Financial Times “comes at a time metal prices have pulled back because of macroeconomic weakness but are expected to rise rapidly on a surge in demand, particularly for electric vehicle batteries, renewable energy and power grids, as supply struggles to keep pace. However, valuations of mining companies have been hit by investor concerns over environmental, social and governance risks as well as geopolitical volatility and the boom-bust nature of commodity markets, which have led institutional shareholders to reduce their exposure to the sector.”

Mind also the recently formed joint venture between Saudi Arabian Public Investment Fund and Saudi Arabian Mining Company. In mid-2023 it made its first investment, buying 14% of Vale’s base metals business for 3.4bn USD in cash. What metals? Oh, Copper and Nickel. Incidentally that’s also Boliden’s key metals.

The hurdle for the Boliden stock to work from here is relatively low. We simply need a period with less extreme events than the past 1-2 years, metal markets that don’t collapse, and restored confidence in management’s capabilities as asset allocators and mine operators. Confidence is key for the market to be willing to look through the 2024 misery on cash flow and operations. A new management, with an appreciation of the importance of capital markets communication and a less, shall we say, “not humble” approach, could shortcut the revaluation.

Hunting season is beginning for mining assets, and Boliden is a wide open target

There is a non-zero chance an activist or strategic investor enters the fray. With zero dominating shareholders and domestic investors practically gone from the shareholder roster, the playing field is wide open. Responsible green metals from efficient and electrified mines in some of the most politically stable countries in the world (Sweden, Finland, Ireland), should warrant a close look in a global context.

We are surprised there is no counter-cyclical pension fund or savvy industrialist domestically willing to look through the current transient malaise and take the reins on the cheap. You could accumulate a controlling 10% stake for a mere 700m USD at the current share price.

In addition, the stock has de-coupled to a record spread vs the indexed underlying commodity exposure it normally tracks closely. At a minimum, this should mean revert.

We have bought a starting position in Boliden. Wary of the cyclicality of metal markets and the management’s long history of poor communication and underwhelming execution we have sized it with caution. We’d love to buy more – but need signs there is someone at the wheel. Someone who cares about capex discipline and shareholders. We think a new management team could wipe the slate clean and start re-building confidence in what could well be a multi-year winner.

If you own shares, or run an activist fund with more money than our little pittance, feel free to reach out.

Protean Small Cap - Carl’s upate for February

February was a decent month for Protean Small Cap. We close the month at +2.1%, meaning that performance since inception in June lands at +15.9%. In doing so we closed 0.9% ahead of our CSXRN (SEK) benchmark for the month, and 9.8% ahead since start.

Cargotec became our biggest contributor during the month. It has been a strong performer since inception of the fund, and we have been vocal about the narrative change that was to happen in this misunderstood Finnish industrial. It reminds us of the gradual revaluation of Trelleborg that has taken place during the last couple of years. Typically, it takes longer to begin that you initially believe, but it lasts longer and pushes the multiples further north than you can expect. Cargotec’s businesses are handling the downturn really well, are positioned for the upturn and with debt free balance sheet (even prior to the would-be MacGregor divestment) there’s ample M&A potential ahead. Valuation remains very appealing.

ITAB Shop Concept wasn’t a part of the portfolio as we entered February. It still became our second biggest contributor during the month. ITAB provides equipment to stores, everything from lightning to check-out to solutions that help to reduce what’s euphemistically called “shrinkage”. We have been following the turnaround of ITAB with interest. It has it has improved its margins during 2023 despite steep decline in sales. The Q4 report showed that this improvement appeared structural, and we realized that this debt-free company now traded at a meagre 7x EBIT actual 2023 earnings. As Protean Small Cap remains a nimble, opportunistic fund we initiated a position (2%) on the day of the report, and as February turned to March the share had gained by 40%.

Other strong contributors include Ambea, Maven Wireless and CINT.

Notable detractors include Kambi and SOBI. Many have been lured by the siren’s call in the Swedish sports betting platform provider Kambi. For good reasons, the business model is very appealing at face value with high scalability in a business that has a proved offering in an industry with long-term growth. We had resisted for a long time, but unfortunately, we also fell victim to this appeal as the share was trading at the low end of its trading range post two important customer signings in early January. While those two signings might help the outlook longer-term, the guidance for 2024 given by Kambi in conjunction with the Q4 report became a big disappointment. We have trimmed our position but remain shareholders. SOBI’s Q4 report did show the strength of the Beyfortus franchise in line with our thesis, but it had become a crowded trade and the lacklustre performance of the newly acquired Vonjo product spooked the market.

On popular request, we will start to mention our ten biggest positions in Protean Small Cap each month.

Protean Select - update for February

*We illustrate our performance by showing a comparison with the NHX Equities index. This is an index constructed from the performance of 54 Nordic hedge funds focusing on equity strategies. NHX is published after our Partner Letter, so updates with one-month lag in the chart above. We aim to have positive returns regardless of the market, but no return is created in a vacuum, and a net-long strategy will correlate. Our hurdle rate is >8% annualized (4% + 90-day Swedish T-bills). All figures are net of fees.

Protean Select posted 0.25% return in February. That’s +1.24% YTD and +14.94% since inception 22 months ago. The realized volatility in the strategy keeps hovering below 7%, which, gives a feel for how much risk we take to generate this return. It is approximately a third of the realized volatility of the overall market.

With a bit of perspective, it’s been a terrible market for small caps since we started this project. In almost two years, the small cap index has only in the past months made it into positive territory. When confidence in the outlook softens and discount rates rise simultaneously, it’s a toxic mix for small caps where the market sees most value from outer year growth. Our money is on this correcting to a more normal state in the years to come, which is why remain stubbornly overweight smaller capitalization stocks.

In the month we saw the biggest contribution from our holding in Cargotec, as it seems more and more investors are waking up to the imminent split-up of the company. Ambea and Nordnet were also strong contributors to returns. Funnily enough Swedbank makes into the top 5 for February too – we bought the position when we changed from outright negative banks to somewhat positive. It is an example of what we hope to be able to do: be adaptive when markets and narratives change.

Our biggest detractor was SOBI. An annoying one. We bought it very early and well and rode it the entire discovery process of how strong Beyfortus-sales was going to be in the US. In hindsight, that the stock dropped on the day when Sanofi reported figures, and the cat was out of the bag, should have been a dead give-away that the stock was over-owned and that it had now travelled and arrived. Egg on our face in February, but the position remains well in the money since inception and has started to recover as more data points on Vonjo developments are coming through the grape wines.

Rusta had a poor showing as well, after a very strong run. Surely not helped by significant IT-issues as their big supplier TietoEvry fell victim to a ransomware attack that affected both payment systems and online shopping. Luckily Q1 is a small quarter for Rusta, so the timing wasn’t too bad. The cost estimates have been communicated clearly and should be adjusted for as it is a true transient one-off cost. We continue to like Rusta which has a high share of EMV, margin upside and a credible roll-out story with traction in several countries outside of Sweden.

True to our idea to generate reasonable returns at reasonable risk we currently run a net exposure around 40%, somewhat higher than historically, a reflection of our more optimistic market outlook.

Ramil’s corner: lessons from the buy-side

…or as some would say: How the Real World Works. After eight months on the Protean-side I have been psychologically tested on the daily ever since that warm Stockholm-summer day I joined. No doubt will I continue to be. These are my key learnings so far.

Positioning matters – life is not an Excel sheet

I would consider myself erring on the model-oriented side compared to the average active manager in the Nordics. In many cases, that could be perceived as bragging. Here’s the catch though; it is not. Life is not a sheet in Excel. Just because you have made an elaborate model, doesn’t mean you have a right to returns. Positioning matters more.

Case in point; Cint’s Q4-report where I, upon opening the report and comparing it to my model estimates, concluded there was no other scenario than for the stock to come tumbling down. Oh boy was I wrong. Why? There are a plethora of arguments:

1) investors buying into the numbers were not buying on the expectation of a strong Q4;

2) (previous?) shareholders who have sold on the notion of never-ending disappointments have been done selling for a while; and,

3) 2024 is firmly communicated to be a better year (helped by large-scale integration efforts coming to an end, elections, and troughing end-markets).

As much as factor 1) and 2) can be considered technicalities, they matter immensely. Luckily, I have colleagues who are better at this, and we retained our entire Cint-holding (it was even upsized ahead of the report).

Pretending to be the smartest in the room rarely plays to your advantage.

The issue is twofold. First, I remember moderating crammed company presentations where zero investors raised their hands and asked questions. In rooms with fewer competitors, investors were more willing to engage. Why? My working thesis is that we are afraid of asking questions to which one could be expected to know the answer to.

Here’s the catch though; it is virtually impossible for the average sized brain (mine) to remember the details of all companies across the Nordics, in all sectors and all market caps. That even goes for some of our core holdings too. Expect a ton of stupid questions from me if you ever end up in the same room as me at a company presentation.

Secondly, this reasoning can be applied to how one operates in the market. It is easy to succumb to the belief that ‘my knowledge of a company or a stock is superior to the counterparty’s’. Equally though, over-analysing what missing variables there are will tilt you towards inaction. In my debut contribution to this letter (August 2023) I outlined the perceived importance of finding the increment that moves a stock beyond the short-term random walk. This is incredibly hard, but understanding a company and its fundamentals sure help. Everything else falls under the umbrella “I am too stupid to understand” (I love saying that to brokers pitching cases too far outside my circle of competence!).

All of a sudden, no need to “Have a View on Everything”

“Sell side is just showbiz” a senior research colleague told me in 2020 when I was pondering a downgrade of the best performing stock in Europe after a run that was nothing short of crazy. Showbiz indeed. At a sales or research desk, telling the client that you do not have a view on a stock might earn you brownie points but is guaranteed to not earn any commissions. I have been (and still am) struggling with this. Waking up every morning and being fed datapoint after datapoint on all matters, it is incredibly challenging at times sometimes to resist the temptation of being consumed by news snippets and instead spend the day hunched over transcripts, annual reports, or research on a company. Evenings and weekends provide you this opportunity but at a certain cost. This is where being bit by the stock bug comes in handy.

Paranoia is good, but balancing paranoia and conviction is the hardest thing!

This might be counterintuitive. I believe being paranoid puts you in a position of not getting married to any single position and instead constantly remain open to absorbing new datapoints. Equally though, a majority of datapoints are noise. Being able to differentiate between an actionable datapoint that alters the case, an actionable datapoint that impacts the case but is not enough for you to change views, and pure noise is probably the hardest thing to do. As an analyst, this is easier to do. You cover ten stocks on average. Of these, a fair share of your time is spent on a few and the rest are just in maintenance mode. This enables you to create and recall an uninterrupted stream of datapoints whilst knowing the company in depth. As a general investor, this is impossible. Having done the work and acted on a given stock before proceeding to look at ten other ideas (most of which render nothing though) while remembering the why of the first idea is hard.

The marginal utility of staring at live prices is negative

This requires zero explanation. If anyone has an antidote to staring at the screen too much and wondering why stock X is underperforming its benchmark by 20bps, I am all ears. With no science behind it, I am pretty sure that I have on aggregate closed 5 what-would-have-been profitable trades because being spooked by pure random walk.

It is equally about avoiding losers as it is about finding winners…

In my second week back in Stockholm I ran into an old client and friend who manages money at a big investment firm. We started talking about cases. I told him I think that binary stock X could be a good story. His answer? “Great case, but if I were to invest in that and it turned out to be the case you envisage, my bonus increases by a few percentage points; whereas if it does not, I risk outflows and my career.”

Investing privately as a 20-something self-proclaimed invincible is a completely different ballgame than investing in an institutional setting. We have a fiduciary responsibility towards our investors of managing their (and our) money to the best of our ability. And that ability must cater to someone looking for the marketed risk profile. Rest assured our advertised (and actual) risk profile differs materially from how I used to invest privately. Risk-adjust your returns.

…but we are in the business of taking risks

Indecisiveness is a ‘no bueno’ (as our COO Daniel Mackey would say). We are in the business of taking risks. We are in the business of actioning on ideas where we believe we have an edge. Nagging, moaning and grumbling about what-ifs and would-haves yield nothing. It is exhausting and can easily put you in state of risk aversion. I am pretty sure Pontus and Carl are tired of me doing this daily – even during the best of days I struggle to convince myself that focus should be on the generation of new ideas to which I take action, or for that matter nurture existing ideas. Every day there are heaps of new opportunities. Move on.

Conviction is about adding to the position despite it moving against you

“We want you to find ideas where conviction is strong enough for you to add when it goes against you” Pontus told me early on. And it does sound like an easy thing to do; but this ties into balancing being paranoid and staring at the screen too much. When a stock moves against you with no visible news (=staring at the screen too much), you assume there is something out there which you do not know about (=paranoia). Balance it out.

Case in point: We have been owners of Scandic Hotels for some time. After a successful repurchase of a third of the sizeable outstanding convertible; continued strong hotel markets; and a compelling valuation of sub-5x EBITDA (IFRS 16-adjusted), we bought more going into Q4 numbers. Numbers were good. We met with management after and left with a good impression. But the stock came tumbling down a rough 10% over the course of two days. We bought some more on the way down. Halfway through the slide, paranoia kicks in… What to do? Ask yourself, why do I own this and if sellers know something you do not, what could that be within reasonable bounds?

As much as everyone loves a good Buffett or Munger quote to wrap a chapter up, I think Ian Cassel of the Micro Cap Club is a great writer of all things investing. He recently wrote: “The truth is we over-emphasize the importance of discovery. Only on a few occasions over a 20-year career do I ever remember buying a stock where the stock immediately went up and never came back down”. Somewhat counter-intuitively, this analogy can be made to a scenario where a position moves against you for no fundamental reason at all. Inherently, the shorter the time frame the more likely it is that any movement relate to random walks (or overly eager buyers and sellers).

The monthly reminder

We optimise for performance, not for convenience, size, or marketing.

You can withdraw money only quarterly (monthly in Small Cap).

We will tell you very little about our holdings.

Our strategy is tricky to describe as we aim to be versatile.

A hedge fund can lose money even if markets are up.

We charge a performance fee if we do well.

You do not get a discount if you have a larger sum to invest.

We do not have a long track record.

Thank you for being an investor.

Pontus Dackmo

CEO & Investment Manager

Protean Funds Scandinavia AB