Short-term bored, long-term excited - August 2023

Dear partners,

Protean Select returned -1.3% in August. The year-to-date return is now +0.5%. Since our start, 16 months ago, the fund has returned +9.5% (beating all Nordic benchmarks, with lower risk).

Protean Small Cap returned -3.6% in August. After three months, the fund is 0.6% points ahead of its Carnegie Nordic Small Cap-benchmark. Thank you for being an investor.

*We illustrate our performance by showing a comparison with the NHX Equities index. This is an index constructed from the performance of 54 Nordic hedge funds focusing on equity strategies. We aim to have positive returns regardless of the market. No return is created in a vacuum, and a net-long strategy will correlate. Our hurdle rate is 8% annualized (4% + 90-day Swedish T-bills). All performance figures are net of fees.

TLDR (too long; didn’t-read version)

· Protean Select returned -1.3% for the month, +0.5% YTD and +9.5% since inception.

· Raysearch, Novo Nordisk and our small cap short-basket were top contributors.

· Storskogen, Smartoptics and EG7 were the biggest detractors.

· Protean Small Cap returned -3.6% in its third month.

· Raysearch, Alleima and Balder were top contributors.

· Storskogen, Thunderful and Acast were biggest detractors.

· After three months in existence, it is ahead of its benchmark index by 0.6-points.

· The combined assets in our two strategies are now approximately 880m SEK.

· Our net exposure to equities in Protean Select is currently 43%, our gross exposure 112%.

· The portfolio remains diversified. No long position is bigger than 4%, and no single short position is bigger than 1.5%.

What happened in August

The higher net and bigger allocation to small caps we wrote about in July clearly backfired in a sour August. Given the entry-composition of the portfolio, we are not entirely displeased to “only” be down -1.3% for the month, if we allow ourselves to glance at the local indices. Obviously, it’s not where we want to be, but as you know we will never perfectly buy a bottom or sell a top.

We have had a very active month. The team has met well over 60 companies to gauge sentiment, the business cycle, find data points, challenge managements, and generally try and connect the dots of where the world is heading. A common theme in most of these meetings is one of heightened uncertainty. Where is end demand going, is de-stocking done, what’s happening to order intakes in the coming quarters, what margin is sustainable after a multi-year period of weird component and freight pricing due to Covid? It’s easy to get mired in pessimism as a reflection of these inputs, but the market is a discounting mechanism: if everyone is expressing solid negativism about the outlook, this is also discounted in share prices. Like the quote from Barton Biggs that Ramil is using in his section of the Partner Letter below, it’s change at the margin that moves markets.

As a consequence of all this input, we have made several changes to the composition of the portfolios.

To give you a few examples of what we’re thinking, there is an interesting dichotomy in the small cap tech space. Some of the weakness seen in end markets are likely of a cyclical nature but are being interpreted and valued as a structural decline. What if the, say, ad revenue or operator capex declines are cyclical not structural? If so, there are a handful of names bound to perform extremely well at the first signs of a recovery. Like bombed out names Truecaller, Cint or Acast.

Or what about real estate companies – are we approaching a peak interest rate level? Interesting emerging signs last week that the bond market has opened up again – where two Swedish companies managed to print re-financings without paying an absolute arm and a leg. With index-linked contracts, and vacancies (so far) under control, and limited development risks, and prudent balance sheets, we can see this sector start to perform. We are no longer underweight real estate companies.

One area where we think there is further downside is consumer discretionary. Perhaps a consensus trade for some time, but there are several stocks where we recently have seen a false start – the market is discounting a quick rebound, but our view is the duration of the slump is likely to be extended. Our interactions with companies in the past months stand in stark contrast to how the equities have performed. Instead of assuming a pick-up from here, we think 2024 will be a(nother) lost year. We express this view via a handful of single-stock shorts.

Protean Select – update for August

Raysearch, where we have taken a big position in both funds, and detailed our thinking in last month’s Partner Letter, was the star of August. We are very pleased the company did exactly what we recommended them to do: establish a medium-term margin target, as that shows commitment to cost awareness, a key variable to re-establish trust in management. We continue to believe there is substantial upside. Our second-best performer was Novo Nordisk. The Danish giant popped on the important SELECT-trial showing a meaningful reduction in CV risk from their obesity medication. We still do not find Novo particularly expensive and think analysts comparing the stock to diversified regular pharma companies are missing the point.

On the negative side, the volatility in controversial Storskogen continued. It has now been in the top three performers a handful of times, and in the bottom three performers an equal number. Funnily enough, it closed the month basically at the levels we bought the stock the first time. We are flat on the position. We think they are doing the right things given the cards they have been dealt, and the reaction to the Q2 report was harsh. The equity is too cheap down here and we are keeping our shares.

Smartoptics was the second biggest loser for the month – an illiquid Norwegian-listed Swedish tech company that boasts fast growth and high ROE, taking market share from a low base in a big global industry. The quarter saw growth rates slow somewhat due to last year being boosted by 5G project, which apparently caused some to sell the stock down. We disagree. It’s a fast grower trading on a substantial discount to comparable companies, and we wouldn’t be surprised to see a take-out attempt should the stock remain at these levels for long.

Protean Small Cap – update for August (from Carl)

August marked the third month of existence for Protean Small Cap, and the first month of underperformance. It won’t be the last. Volatility and a lack of liquidity is the drawback of investing in smaller companies, but it does feel a bit worse than normal right now. Our new position in Acast caused us a 0.4% headwind during the month, simply because of random walk on thin volumes. Truth be told, had we had a 0.4% tailwind on poor volumes we would have probably seen it as ‘business as usual’ but that’s how we humans operate.

As mentioned, our best performers were Raysearch, Alleima and Balder. Storskogen, Thunderful and Acast were biggest detractors. Alleima had a great run in the last days of the month, as the main owner Lundberg began adding to their position. Since Alleima’s spin-off from Sandvik, the two main owners Lundbergs and Industrivärden have added 12.2% of the stock to their holding. Those shares won’t be sold tomorrow, or probably ever. Alleima remains one of our long-term holdings in the fund as we see an underestimated earnings power emerging during 2024, and the balance sheet is likely to support stronger-than-expected profit growth during the cyclical downturn that is emerging in many parts of the economy.

The sudden spike in Alleima brings us to the topic of catalysts: are we happy to hold a stock ‘only’ because we see a long-term potential, having the patience and courage to trust that others will come to the same conclusion as us? Or do we need to have an ‘event’ to happen within a certain time frame, making the case outcome binary? The answer is “It varies”. One of the losers of the month is a case in point: Thunderful. Here we had a ‘catalyst’ – we thought Q2 would be a great earnings print. Cue the Q2 report: we were completely wrong. It’s as simple as that. To add to the insult: apparently a lot of others had made the same incorrect analysis. As the ‘catalyst’ was behind us, we were not alone in concluding that Thunderful is dead money for several quarters (at best) ahead. That’s what creates the big move on the downside (that hurt a lot), even though it was one of the smaller positions in the fund.

To end on a positive note, we see more opportunities than for quite some time. The tough part is to see how they will play out. That’s why we want our investors to be long-term because we can only promise two things: volatility from the fund and commitment from us. The rest is up to (calculated) chance.

Short-term boring, long-term exciting

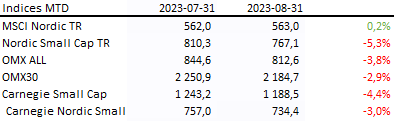

The below are the Nordic indices we keep an eye on to gauge the temperature out there. The matrix shows performance since the launch of the fund on the 2nd of May 2022. Despite a luke-warm 2023 so far, the fund has in absolute terms outperformed every single index since inception and done so with a third of the volatility. This is exactly what we’re aiming for. We do not manage the fund with a view to perform every month. We manage the fund with a view to generate reasonable absolute returns with reasonable risk, over a rolling three-year horizon.

Yes, it’s frustrating with sideways or slightly down performance on a monthly or quarterly basis, but it’s an inevitable part of the game to have softer and stronger periods. We are not investing in a vacuum. With our net-long bias we will correlate with overall markets. And since we also have a sizeable allocation to small caps, we will suffer some of the added volatility of that asset class.

To be honest, these types of passages are incredibly boring to write. You only ever write them when you’re not happy with performance. That we’re only up 0.5% year to date isn’t great. It’s boring. Heck, I’d love to be up 5% every month. But you cannot do that and at the same time try to protect the downside. It just isn’t doable. There is a reason “Fund of the Year” winners often are the worst fund of the lot the year after: they take big directional risks and are often unable to change.

We believe the way to compound capital optimally is to do so without suffering big drawdowns. The feature of Protean Select that we are adaptable and versatile, is why we are not a “product” that fits well into institutional frameworks. We manage the fund trying to optimize for performance, not for asset gathering and being everything to everyone. This is why we put restrictions in place for withdrawals – only every three months. This is why we say very little about our holdings, bearish for marketing but bullish for our mental health and decision-making process. This is why we cap the strategy at 2bn SEK.

We are not for everyone. And that’s fine. We are for ourselves, and for our returns.

The past 6 month’s performance has been boring. But beating every index in the Nordics over 16 months with substantially lower risk – that’s exciting!

Ramil’s corner – Introduction of our latest addition to the team

By way of introduction, my name is Ramil Koria, I joined Protean two months ago on the day to complement Pontus and Carl in the management of both funds. My journey to this role spans over seven and a half years at SEB, where five of those years were dedicated to Equity Research. During this time, I had the privilege of leading our efforts within the IT/tech sector during a period of remarkable growth. My coverage included notable companies such as Sinch, Kinnevik, and Fortnox, and I had the opportunity to be part of several IPOs, including but not limited to Nordnet, EQT, Truecaller, Momentum Software, and Pagero. Additionally, I delved into the intricacies of dual-tracked companies such as Trustly and PriceRunner ahead of their acquisition by Klarna.

Now, you may wonder why I mention these companies. Well, for the simple reason that it serves the purpose of showing that, despite being entrenched in IT/tech-land formally, I have always thoroughly enjoyed learning about new companies in new sectors and industries. In extension, this was also what led me to move to London to work as a sector generalist Equity Sales representative at SEB. There, I got to serve some of the world's largest multi-strategy hedge funds, often referred to as "pod shops." This presented two significant challenges. First, I had to expand my knowledge beyond small, illiquid sectors to focus on companies with market capitalizations exceeding SEK 30 billion. Second, I engaged daily with trading-intensive, data-driven, sector-specific pods, an arena notorious for its high staff turnover. By chance, I was invited to participate in clients' alpha capture platforms, some of which were sophisticated enough to allocate funds, establish Bloomberg chats with designated traders, and allow counterparts to become outright money managers. Helped by a good performance on the various platforms, this cemented my desire to take the step to join Pontus and Carl.

My (non-fixed and highly transformable) investment philosophy

Being a research analyst with work ethic in your low 20s is stellar: management is keen to interact with you, clients do not particularly care about who you are and what your background is, they simply solely care to listen if you have something interesting to say (which also makes Equity Research a meritocracy); and, most importantly, there is always an increment to chase. The last point has defined me in adventures also after my tenure as a Research Analyst, I constantly look for incremental datapoints. Change at the margin is what moves markets. This was eloquently expressed in my favourite finance-related book, “Hedgehogging” by the late Barton Biggs.

“I find it’s almost impossible to do serious reading in the office because there are so many interruptions, so I spend a lot of time nights and weekends reading. Often I wonder if it’s all worthwhile or just an addiction. Although I know there is no direct correlation on a day-to-day basis between reading and making money, somehow I feel less guilty if I read everything in my in-box. As investment managers, we must control our reading by being disciplined and ruthlessly selective rather than let it rule us. I want original information or analysis about the state of the world, an industry, or a company that is going to help me make money. Change at the margin is what moves markets.”

However, I must emphasize that claiming to possess a fixed investment philosophy at this early stage of my buy-side career would be inaccurate. I firmly believe that Protean can maintain a competitive edge over time, but I also understand that this edge will evolve in response to market dynamics. Consequently, we will refrain from expressing a preference for either growth or value investing. Having witnessed both sides of the coin, from the tech sector's growth dominance in 2020-21 to the resurgence of value (well, outperformance at least) investing in 2022-23, I recognize the ever-changing nature of markets. My approach is adaptable, far from dogmatic, and firmly rooted in the pursuit of performance.

Why Protean?

Throughout my career, I've explored opportunities with various investment managers. However, none fully resonated with me until Protean crossed my path. Our alignment on critical aspects such as fund structure, collaborative work dynamics, risk tolerance, sector/geographical/asset class mandates, investment processes, and shared investment philosophies was evident from the start.

Data is abundant. We live in an information overflow. We receive constant reports from analysts at brokers. We receive a steady stream of ideas from forward-leaning sales contacts. We monitor news flow across the globe on all matters. Point being: we are datapoint-chasers but by no means is it easy to find the incremental datapoint that is the mover of any given stock, sector or index. To have the stamina to search for the needle in the haystack that the incremental datapoint is requires a genuine interest for the market. After two months at the firm, and several more years of prior interaction with Pontus (we were colleagues at SEB, in fact I vividly remember initiating coverage of Hoist Finance our first day as colleagues) and Carl (we have exchanged ideas and datapoints frequently in the last few years), I sincerely feel like our small office room where all three sit together with our COO Daniel Mackey, is infected by the notorious stock bug. We breathe stocks.

What I bring to the table

I make no promises that we cannot fulfill. However, my utmost ambition is to enrich our stock-picking process at Protean with a perspective that is different from my co-managers. I believe we complement each other very well; Pontus and Carl bring a very different skillset than me, and we challenge each other on each idea and each position frequently. I am here to learn, grow, and contribute to our collective goal of generating healthy, risk-adjusted returns for our investors and, by extension, for ourselves as co-investors.

The monthly reminder

We optimize for performance, not for convenience, size, or marketing.

You can withdraw money only quarterly (monthly in Small Cap).

We will tell you very little about our holdings.

Our strategy is tricky to describe as we aim to be versatile.

A hedge fund can lose money even if markets are up.

We charge a performance fee if we do well.

You do not get a discount if you have a larger sum to invest.

We do not have a long track record.

Pontus Dackmo

CEO & Investment Manager

Protean Funds Scandinavia AB